Bitcoin on Other Blockchains: WBTC, Solana & Layer 2s Explained

Bitcoin was originally designed as a simple, secure peer-to-peer payment system. Its core focus on security and decentralization made it the most trusted blockchain but also limited its programmability compared to smart contract platforms like Ethereum.

As crypto adoption grew, developers began asking an important question:

How can Bitcoin be used across other blockchains without changing its core design?

This led to the rise of Bitcoin on other blockchains, including Wrapped Bitcoin (WBTC), Bitcoin on Solana, and Bitcoin Layer 2 solutions.

Let’s break it down simply.

Why Bitcoin Needs Other Blockchains

Bitcoin uses a UTXO-based model and a deliberately limited scripting language. This makes Bitcoin extremely secure but less flexible for advanced applications like DeFi, NFTs, or complex smart contracts.

Other blockchains (like Ethereum and Solana) offer:

- Faster transactions

- Smart contract programmability

- DeFi and application ecosystems

To combine Bitcoin’s security with these features, cross-chain Bitcoin solutions were created.

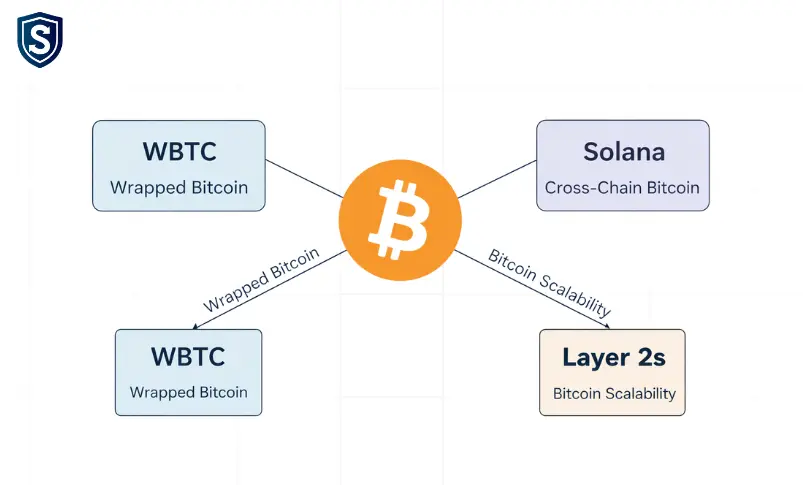

What Does “Bitcoin on Other Blockchains” Mean?

Bitcoin does not physically move to another chain.

Instead:

- Bitcoin is locked on the Bitcoin blockchain

- A representation of Bitcoin is issued on another blockchain

- This representation can be used in DeFi, trading, and smart contracts

This process is called tokenized Bitcoin.

Wrapped Bitcoin (WBTC) Explained

Wrapped Bitcoin (WBTC) is the most widely used way to use Bitcoin on Ethereum.

How WBTC Works

- BTC is locked with a custodian

- An equivalent amount of WBTC is minted on Ethereum

- WBTC can be used in DeFi protocols

- WBTC can be burned to redeem BTC

Key Features of WBTC

- ERC-20 compatible

- Used in lending, DEXs, and yield protocols

- Backed 1:1 with BTC

Limitations

- Custodial trust required

- Not native to Bitcoin

- Regulatory dependency

WBTC solved early demand—but introduced centralization risk.

Bitcoin on Solana: Faster, Cheaper, Riskier?

Solana offers high-speed, low-cost transactions, making it attractive for Bitcoin users.

How Bitcoin Works on Solana

- BTC is bridged using wrapped or synthetic assets

- Tokens represent BTC value on Solana

- Used for fast trading and DeFi strategies

Pros

- Extremely fast execution

- Low transaction fees

- Strong DeFi tooling

Cons

- Bridge security risks

- Not secured by Bitcoin miners

- Dependency on Solana’s runtime

This makes Bitcoin on Solana powerful but less aligned with Bitcoin’s security model.

Bitcoin Layer 2s: Scaling Bitcoin Without Leaving It

Bitcoin Layer 2 solutions aim to improve performance without moving Bitcoin to another chain.

What Are Bitcoin Layer 2s?

Layer 2s operate on top of Bitcoin, using Bitcoin for settlement and security.

Examples include:

- Lightning Network

- BitVM-based designs

- Bitcoin rollup-like constructions

Benefits

- Retain Bitcoin’s security model

- Improve scalability and speed

- Enable more complex logic

Layer 2s are inspired by Ethereum’s rollups but adapted to Bitcoin’s UTXO architecture.

How Taproot Changed Bitcoin’s Programmability

The Taproot upgrade (2021) was a major milestone for Bitcoin.

Taproot introduced:

- Schnorr signatures

- Better privacy

- More flexible scripting

This enabled:

- More expressive smart contract-like behavior

- Protocols like Ordinals, BitVM, and advanced Layer 2 designs

- Growth of the modern Bitcoin ecosystem

Taproot made Bitcoin Layer 2 development practical without compromising security.

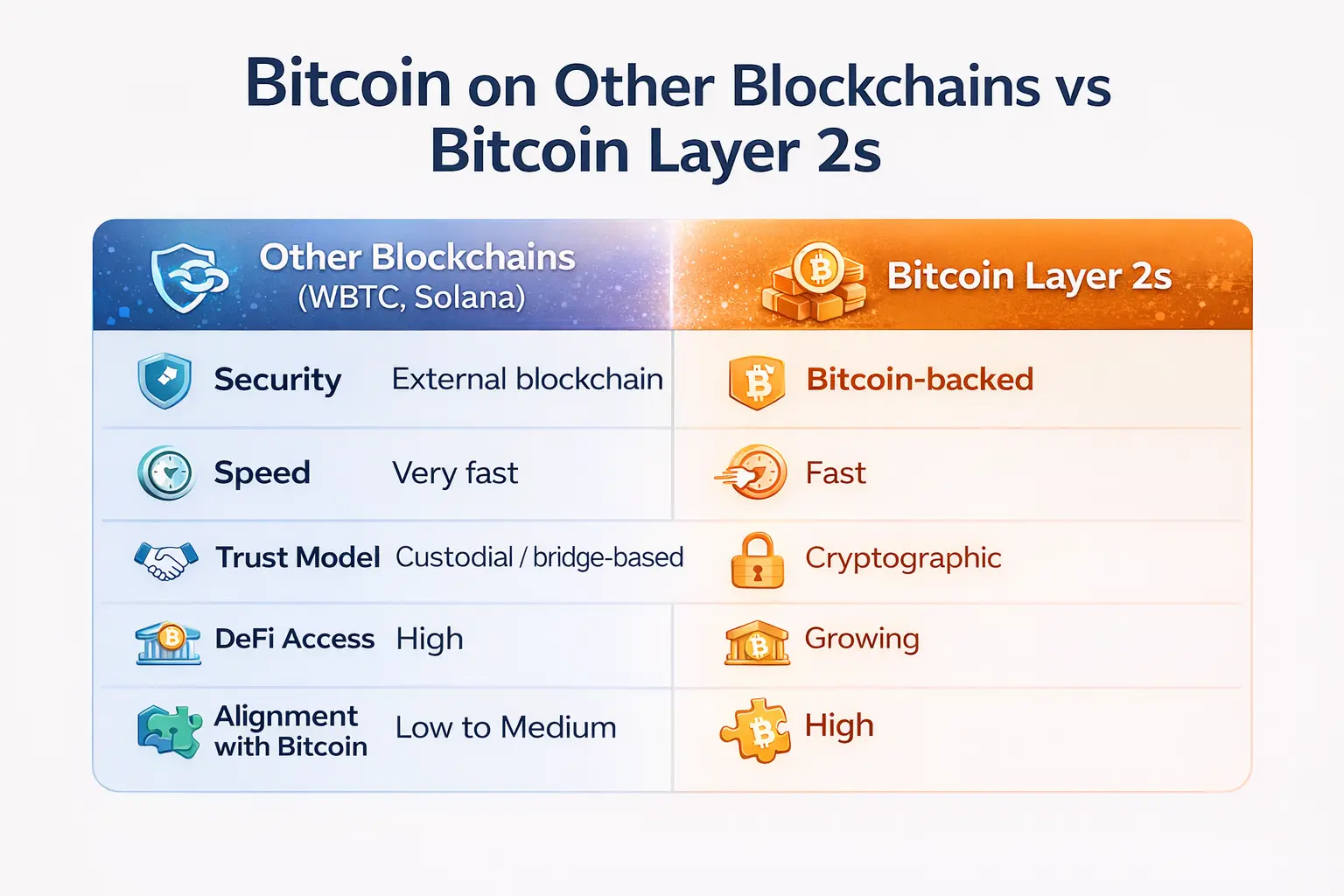

Bitcoin on Other Blockchains vs Bitcoin Layer 2s

Both approaches serve different use cases.

Why This Matters for the Future of Bitcoin

Bitcoin is evolving from:

- A simple payment network → A multi-layer financial ecosystem

Cross-chain Bitcoin and Layer 2s allow Bitcoin to:

- Participate in DeFi

- Scale without sacrificing security

- Remain relevant in a multi-chain world

The future is not Bitcoin vs other chains it’s Bitcoin working across chains.

SwiftEx and Multi-Chain Bitcoin Access

SwiftEx supports the vision of Bitcoin on other blockchains through a non-custodial, multi-chain wallet and DEX experience.

SwiftEx enables users to:

- Maintain full asset control

- Access cross-chain liquidity

- Trade Bitcoin-linked assets efficiently

- Avoid custodial lock-in

As Bitcoin Layer 2s and cross-chain solutions mature, SwiftEx is positioned to support secure, flexible Bitcoin usage across ecosystems.

Final Thoughts

Bitcoin was never designed to do everything but it was designed to last.

By extending Bitcoin through:

- Wrapped assets

- Cross-chain bridges

- Layer 2 technologies

The ecosystem preserves Bitcoin’s security while unlocking modern blockchain functionality. Bitcoin on other blockchains is not a compromise it’s an evolution.

Follow us on